Part D late enrollment penalty

-

-

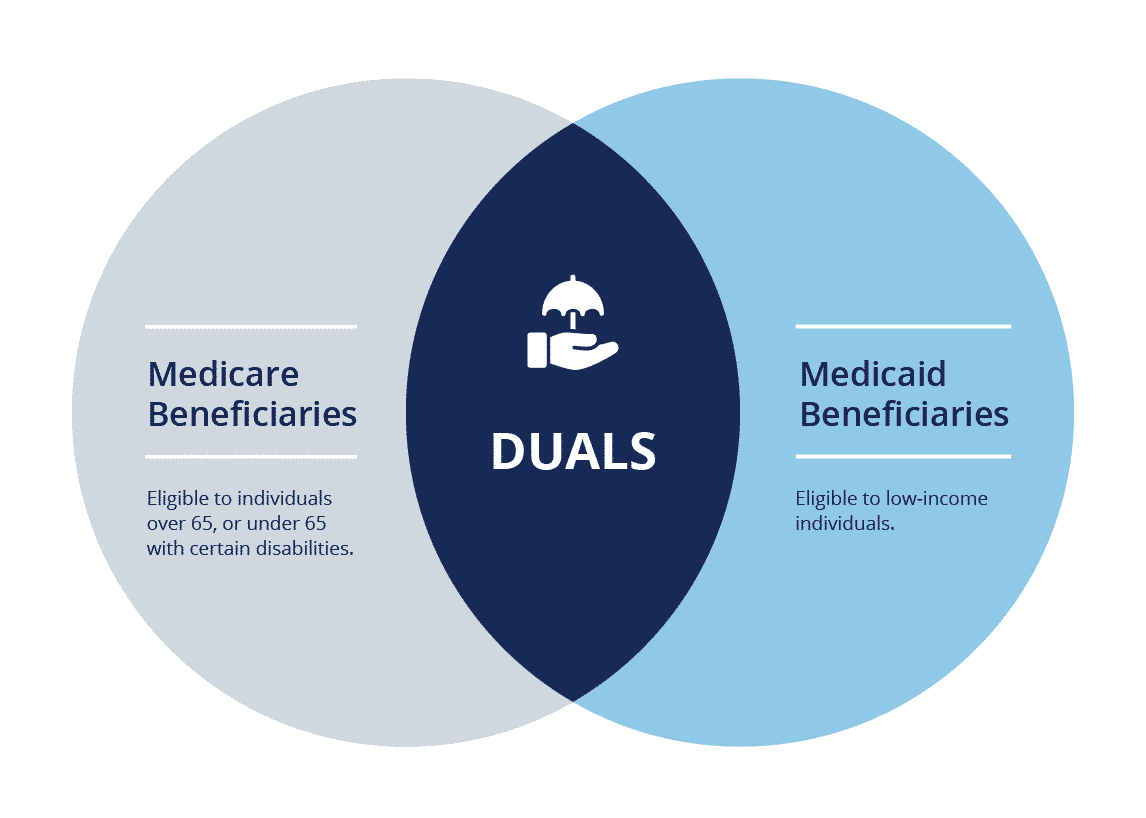

- Generally, you won’t have to pay a Part D penalty if:

- You have

(coverage that’s similar in value to Part D) OR

- You qualify for Extra Help

- You have

- You’ll pay an extra 1% for each month (that’s 12% a year) if you:

- Don’t join a Medicare drug plan when you first get Medicare.

- Go 63 days or more without creditable drug coverage).

- You may also pay a higher premium depending on your income.

- After you join a Medicare drug plan, the plan will tell you if you have to pay a penalty and what your premium will be.

- Generally, you won’t have to pay a Part D penalty if:

-

I am licensed to insurance in MA, KY & FL. I am Bi-lingo (English & Cape Verdean).

I am contracted with many insurance carriers such as Humana, Commonwealth Care Alliance, Aetna, Physicians Mutual, AARP, United HealthCare and more. I specialize in Medicare Products, but also sell Life & Dental insurance for all ages. I would love to talk to you and answer any question that you may have. Feel free to contact me via Text, Email or just Call!